42 the coupon rate of a bond is equal to

Understand Treasuries Contract Specifications - CME Group The minimum price fluctuation, or tick size, is ¼ of a 1/32. Since the face value of the 5-Year Note future is $100,000 a 1/32 is worth $31.25, therefore ¼ of a 1/32 is equal to 0.25 x $31.25 = $7.8125, rounded to the nearest cent per contract. Last trading day and last delivery day are the same as 2-Year Notes. Eurodollar Futures Pricing and the Forward Rate Market - CME Group This implies a return of 0.800% over the entire six-month period. The third alternative means that you invest for the next 270 days at 0.90% and sell June Eurodollar futures at 1.04%, effectively committing to sell the spot investment 180 days hence when it has 90 days until maturity. This implies a return of 0.83% over the next six-months.

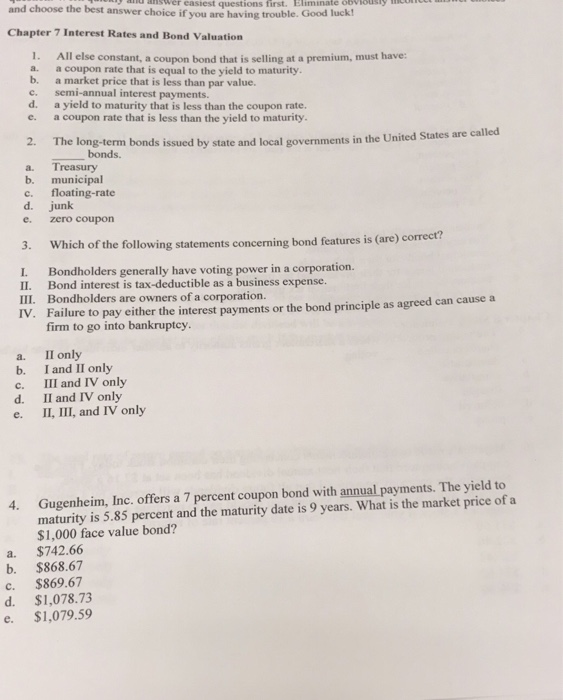

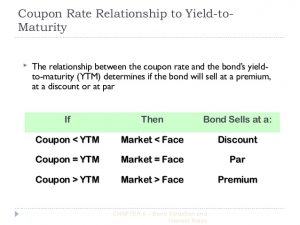

Dividend Yield - BrainMass The bond, which has a $1,000 face value and coupon rate equal to 10 percent, matures in six years. Interest is paid every six months; the next interest payment is scheduled for six months from today. If the yield on similar-risk investments is 14 pe

The coupon rate of a bond is equal to

About Corporate Bonds - NSE - National Stock Exchange India Corporate bonds are debt securities issued by private and public corporations. Companies issue corporate bonds to raise money for a variety of purposes, such as building a new plant, purchasing equipment, or growing the business. When one buys a corporate bond, one lends money to the "issuer," the company that issued the bond. bond prices | StudyHippo.com A 20-year bond with a $1,000 face value has a coupon rate of 8.5% but pays coupons semiannually. The yield to maturity for the bond is 9.5%. Given this information, first coupon that will be paid will be $42.50. Click card to see the answer answer The first semiannual coupon will be (.085 x $1,000) / 2 = $42.50. Click card again to see the question US 10 year Treasury Bond, chart, prices - FT.com Chinese state-owned company accused of endangering rare orang-utans Jun 19 2022; How ESG strategies hurt emerging markets Jun 17 2022; The Bank of Japan will not be bullied Jun 17 2022; Time for strong medicine: How central banks got tough on inflation Jun 17 2022; Yen sinks after Bank of Japan sticks to ultra-loose monetary policy Jun 17 2022; Should investors step back into emerging markets?

The coupon rate of a bond is equal to. United Kingdom Government Bonds - Yields Curve The United Kingdom 10Y Government Bond has a 2.493% yield. 10 Years vs 2 Years bond spread is 28.8 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in June 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency. EDV Vanguard Extended Duration Treasury ETF - Seeking Alpha The advisor employs an indexing investment approach designed to track the performance of the Bloomberg U.S. Treasury STRIPS 20-30 Year Equal Par Bond Index. This index includes zero-coupon U.S ... Kamakura Weekly Forecast, June 17, 2022: Not Exactly Shock and Awe as ... We measure the probability that the 10-year par coupon Treasury yield is lower than the 2-year par coupon Treasury for every scenario in each of the first 80 quarterly periods in the simulation. The next graph shows that the probability of an inverted yield remains high, peaking at 52.5%, compared to 54.9% last week, in the 91-day quarterly ... Investing A bond is an investment representing part or all of a loan to a person, government, or other entity. Bonds are issued at a set par value, usually $1000 or $100, and their prices fluctuates based ...

Finance Archive | June 20, 2022 | Chegg.com 1.LynIT Ltd. issued a 10-year, 7% coupon interest rate, $1,000 par value bond that pays interest semi-annually. The required return is 5%. Compute the value of the bond. $1,155.89 $1,154.4 3 answers 2."Bond X, Bond Y and Bond Z have the following ratings AAA, CCC & BBB respectively. Stock Market | Daily Herald Zero coupon risk is the risk that zero coupon bonds may be highly volatile as interest rates rise or fall. Senior floating-rate loans are usually rated below investment grade but may also be unrated. As a result, the risks associated with these loans are similar to the risks of high-yield fixed income instruments. Personal Loan Calculator: Personal loan EMI ... - The Economic Times The EMI is based on the personal loan amount, the tenure, and interest rate. On a given personal loan amount, interest rate and for a specific duration, the calculator will let you know how much EMI you have to pay. How to use it To arrive at the EMI, one has to input: Loan amount - It has to be between Rs 50,000 and Rs 30 lakh $250,000 Mortgage - Mortgage Calculator Plus Assuming you have a 20% down payment ($50,000), your total mortgage on a $250,000 home would be $200,000 . For a 30-year fixed mortgage with a 3.5% interest rate, you would be looking at a $898 monthly payment. Please keep in mind that the exact cost and monthly payment for your mortgage will vary, depending its length and terms.

MINSHENG BANK Completes RMB5B Capital Bond Issue, Coupon Rate 4.2% for ... The Bonds with an aggregate amount of RMB5 billion have a coupon rate of 4.2% for the first five years, which is subject to adjustment every five years. The proceeds will be used to replenish the... Relationship Between Treasury Notes and Mortgage Rates Investors fled to the safety of government securities pushing yields on the 10-year Treasury note to an all-time low of 0.52% on Aug. 4, 2020. 2 As a result, mortgage rates fell since they tend to follow the yields on U.S. Treasury notes. 3. However, by 2022, the Fed was hiking rates to combat inflation, and by May of 2022, the 10-year Treasury ... Form FWP ROYAL BANK OF CANADA Filed by: ROYAL BANK OF CANADA Because the Final Level of the Reference Asset is less than the Barrier Level, we will pay an amount in cash that will be calculated as follows: $1,000 + ($1,000 x -50%) = $500.00 * * * MicroStrategy Inc. $MSTR': BTC - BBQ Effectively break-even vs bond coupon. Ch. 11 equity to zero. Net return on hedged high yield: +$20,000 on bond long +87,000 on equity short Net +$107,000 2.) 50% recovery rate on bonds Net return...

TLT iShares 20+ Year Treasury Bond ETF - SeekingAlpha A high-level overview of iShares 20+ Year Treasury Bond ETF (TLT) stock. Stay up to date on the latest stock price, chart, news, analysis, fundamentals, trading and investment tools.

FBND | ETF Snapshot - Fidelity Snapshot for the FIDELITY TOTAL BOND ETF ETF (FBND), including recent quote, performance, objective, analyst opinions, and commentary. ... Weighted Average Coupon AS OF 05/31/2022: 3.04%: 30-day SEC Yield AS OF 05/31/2022: 3.66%: Distribution Yield (TTM) ... If only one NRSRO rates the security, that rating is assigned to the holding. If a ...

Germany 10 Years Bond - Historical Data - World Government Bonds The Germany 10 Years Government Bond has a 1.265% yield. Click on Spread value for the historical serie. A positive spread, marked by , means that the 10 Years Bond Yield is higher than the corresponding foreign bond. Instead, a negative spread is marked by a green circle. Click on the values in " Current Spread " column, for the historical ...

First Trust Advisors L.P. Announces Distributions for Exchange-Traded Funds Zero coupon risk is the risk that zero coupon bonds may be highly volatile as interest rates rise or fall. Senior floating-rate loans are usually rated below investment grade but may also be...

Modified Duration | Brilliant Math & Science Wiki By substituting in the formula for Modified Duration, we get that 4.445 = - \frac {1} {1100} \times \frac { \Delta P } { 1 \% }. 4.445 = −11001 × 1%ΔP . This gives us \Delta P = - 4.445 \times 1100 \times 1 \% = - \$48.895 ΔP = −4.445×1100×1% = −$48.895. Thus, the new price would be P + \Delta P = \$1100 - \$48.895 = \$1051.105.

Treasury Rates, Interest Rates, Yields - Barchart.com Interest rate trends and historical interest rates for Treasuries, bank mortgage rates, Dollar libor, swaps, yield curves. ... Like zero-coupon bonds, they do not pay interest prior to maturity; instead they are sold at a discount of the par value to create a positive yield to maturity. Many regard Treasury bills as the least risky investment ...

Biden Administration Overhauls Title IX Rules on School Sexual ... Macy's: Macy's coupon - Sign up to get 25% off next order Michaels : Michaels coupon code for senior - Extra 10% off Saks Fifth Avenue : $20 off sitewide + free shipping - Saks Fifth Avenue coupon

Insurers in Taiwan Pay the Price for Misjudging Covid Risks Fubon Insurance has so far fielded more than 29,000 claims, totaling $37 million in compensation, equal to roughly a third of the company's first-quarter profits.

Post a Comment for "42 the coupon rate of a bond is equal to"