42 what is zero coupon bonds

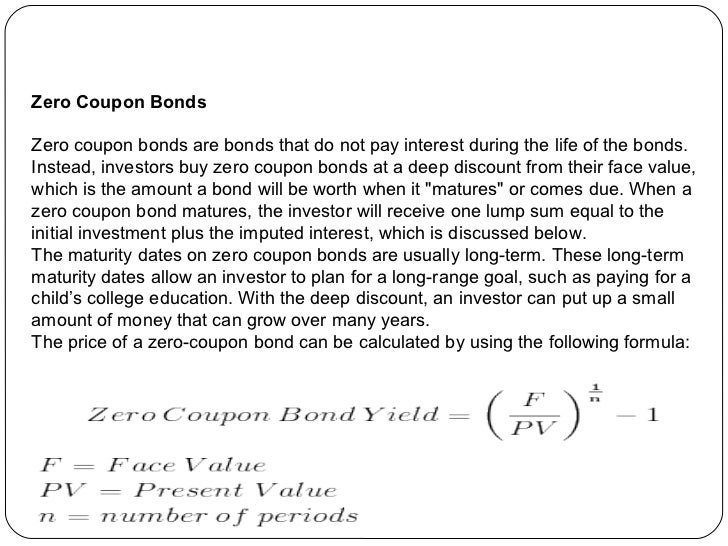

Suppose that you have purchased a 3-year zero-coupon bond with face ... If you have purchased a 3-year zero-coupon bond with face value of $1000 and a price of $850 and if you hold the bond to maturity, the annual return is simply 1/3 of 17.65% ,which equals 5.88%. What is zero-coupon bond? A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value.It also called a pure discount bond or deep discount bond. Zero Coupon Bond Price Calculator Excel (5 Suitable Examples) For zero coupon bond, as there is no periodic payment, pmt is 0; C5 is the fv, which is the Future Value; PV(8%,10,0,20000) → Therefore, this becomes Output:-$9263.87, here the negative sign means outgoing cash flow. Explanation: As a result, -$9263.87 is the Zero Coupon Bond Price.

Understanding Zero Coupon Bonds - Part One - The Balance Zero coupon bonds or zeros don't make regular interest payments like other bonds do. You receive all the interest in one lump sum when the bond matures. You purchase the bond at a deep discount and redeem it a full face value when it matures. The difference is the interest that has accumulated over the years. Various Maturities

What is zero coupon bonds

What is a Zero Coupon Bond? - ICICIdirect Zero-coupon bond is a type of bond that governments and companies issue. Zero-coupon bonds, unlike other bonds, do not give investors a regular interest pay-out. Instead, they are issued at a steep discount to the bond's face value at the time of issuance. That is why they are also called discount bonds. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when... What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond.

What is zero coupon bonds. Notice to the Holders of the €200,000,000 Zero Coupon Exchangeable ... PARIS, July 27, 2022--Regulatory News: Capitalised terms not otherwise defined in this notice shall have the meaning given to them in the terms and conditions of the Bonds (the "Conditions"). What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,... zero coupon bond - Definition, Understanding, and Why zero coupon bond ... What is Zero Coupon Bond. This is an accrual bond that does not pay the interest but trades at a major discount, giving a profit at maturity when the bond is taken out for its total face value.. Understanding Zero-Coupon Bonds. Some bonds are identified as zero-coupon instruments from the beginning. Other bonds are coverted into zero-coupon instruments after a specific institution takes away ... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Explaining Zero-Coupon Bonds - Wolfline Capital A zero-coupon bond usually trades with a deeper discount than a regular bond and offers higher returns than a regular bond with the same maturity because of the shape of the yield curve. With a normal yield curve, long-term bonds have higher yields than short-term bonds. What Is a Zero-Coupon Bond? - The Motley Fool Zero-coupon bonds are debt securities that are sold at deep discounts to face value. As their name indicates, they don't pay periodic interest payments, but they do reach full maturity at a certain... MC Explains | What is a 'zero-coupon, zero-principal' instrument? With its zero-coupon, zero-principal structure, it resembles a debt security like a bond. When an entity takes a loan by issuing regular debt security like a bond, it has to make interest payments ... What are zero coupon bonds and why do people invest in them? Zero coupon bonds are a low-risk investment because the issuer has less incentive to default. Investors typically buy zero coupon bonds because they provide a higher rate of return than traditional bonds. Issuers sell zero coupon bonds at a discount and investors receive the full face value when the bond matures.

Zero-Coupon CDs: What They Are And How They Work | Bankrate Any interest that accrues is usually paid on a monthly basis. Zero-coupon CDs, in comparison, are purchased at a lower price and you receive the entire interest amount at the CD's maturity date. So... What Is a Zero Coupon Yield Curve? - Smart Capital Mind A zero coupon bond does not pay interest but instead carries a discount to its face value. The investor therefore receives one payment of the face value of the bond on its maturity. This face value is the equivalent of the principal invested plus interest over the life of the bond. Zero Coupon Bond: Formula & Examples - Study.com A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of financial... Zero Coupon Bond -Features, benefits, drawbacks, taxability ... - Finity Zero coupon bonds fall under the fixed-income securities segment. These don't pay any interest or coupon, and at the time of maturity, the investor receives the face value or par value. Zero coupon bonds are also referred to as 'Zeroes' by many traders for this reason. These bonds generally have 10-15 years to maturity.

Zero Coupon Municipals Are About To Get Significantly ... - SeekingAlpha Zero coupon bonds are those that don't pay a regular interest coupon. Instead they're issued at a discounted price which when held to maturity and repayment would equal a useful interest rate.

What is a zero bond? - Foley for Senate A zero-coupon bond (also discount bond or deep discount bond) is a bond where the face value is repaid at the time of maturity. Note that this definition assumes a positive time value of money. It does not make periodic interest payments, or have so-called "coupons", hence the term zero-coupon bond. What is the yield to maturity?

Deep Discount bonds and Zero Coupon Bonds - The Fixed Income A cumulative product provides clarity of coupon paid. The taxation of the returns depends on the tax treatment prescribed at the time, varying from being taxed at maturity or on the accrued interest being taken up for tax in the year it is earned. Another avatar of the deep discount bond is the zero-coupon bond (ZCB).

What is the tax implication on zero coupon bonds? myITreturn Helpdesk. 5 months ago. Updated. Any long term capital gain on sale of zero coupon bonds shall be charged to tax at minimum of the following: 20% of LTCG After indexation of cost of such bonds or 10% of LTCG before indexation of cost of such bonds. Zero coupon bonds, Investing in Zero Coupon Bonds, Tax Considerations for Zero Coupon ...

A zero-coupon bond is a discounted investment that can help you save ... A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs at a foreseeable time. Though their yields are higher, "zeros" are more volatile than traditional bonds, and they incur taxes each year.

Government, Zero-Coupon & Floating-Rate Bonds - Study.com A zero-coupon bond is a bond that does not pay out interest but is instead redeemed at its maturity for the face value of the bond. Jane makes money when she can buy the bond for a discount off ...

Deferred Coupon Bonds | Definition, How it works? Types, Advantages Deferred coupon bonds can be Zero-coupon bonds for a specific period of time and then pay a certain interest for the remaining period till maturity. For example, a deferred coupon bond with 4 years as a deferred period with a coupon of 6% will not pay any interest for the first four years from the issuance date. After these initial 4 years, 6% ...

What are Zero Coupon Bonds? Explain some of its variants. Zero-coupon bonds (ZCB), also known as deep discount bonds do not carry any coupon rate. They are issued at a discount and redeemable at par. The amount of discount is equal to the total return for the investor. This can be expressed in terms of interest rate, called the implicit or inherent rate of interest.

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Coupon Bond - Guide, Examples, How Coupon Bonds Work What is a Coupon Bond? A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

What is zero coupon bonds? - myITreturn Help Center Zero-coupon bond (also discount bond or deep discount bond) is a bond bought or issued at a price lower than its face value and the face value repaid at the time of maturity. It does not make periodic interest (coupon) payments. Hence the term is called as zero-coupon bond.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when...

What is a Zero Coupon Bond? - ICICIdirect Zero-coupon bond is a type of bond that governments and companies issue. Zero-coupon bonds, unlike other bonds, do not give investors a regular interest pay-out. Instead, they are issued at a steep discount to the bond's face value at the time of issuance. That is why they are also called discount bonds.

Post a Comment for "42 what is zero coupon bonds"