43 zero coupon bonds definition

Bond Definition: What Are Bonds? – Forbes Advisor Aug 24, 2021 · Zero-Coupon Bonds: As their name suggests, zero-coupon bonds do not make periodic interest payments. Instead, investors buy zero-coupon bonds at a discount to their face value and are repaid the ... Zero-Coupon Bond Definition - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don’t mature for ten ...

Zero coupon bonds definition

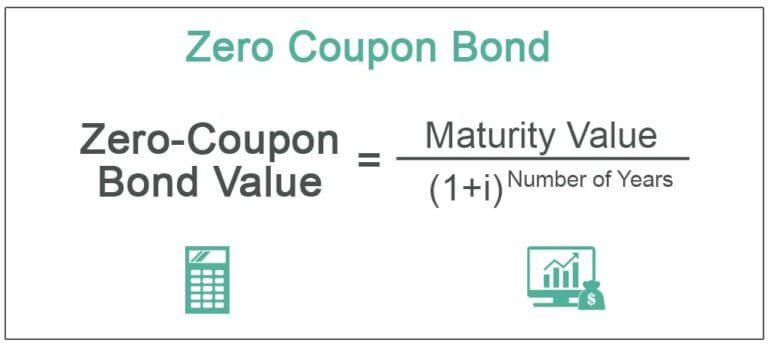

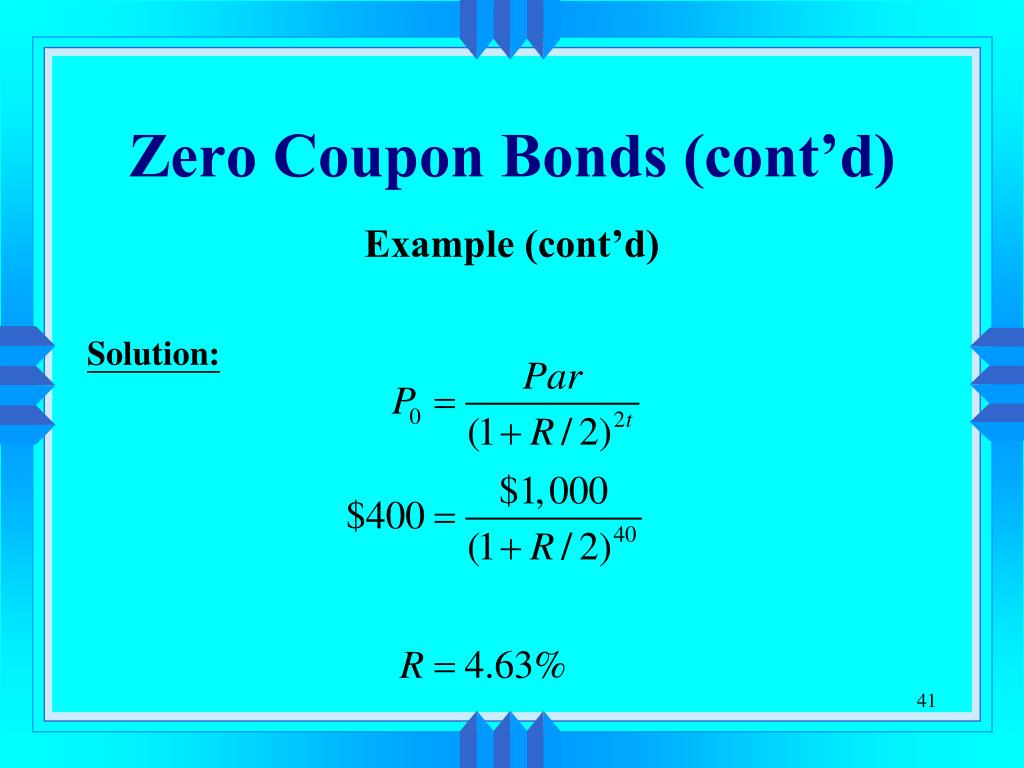

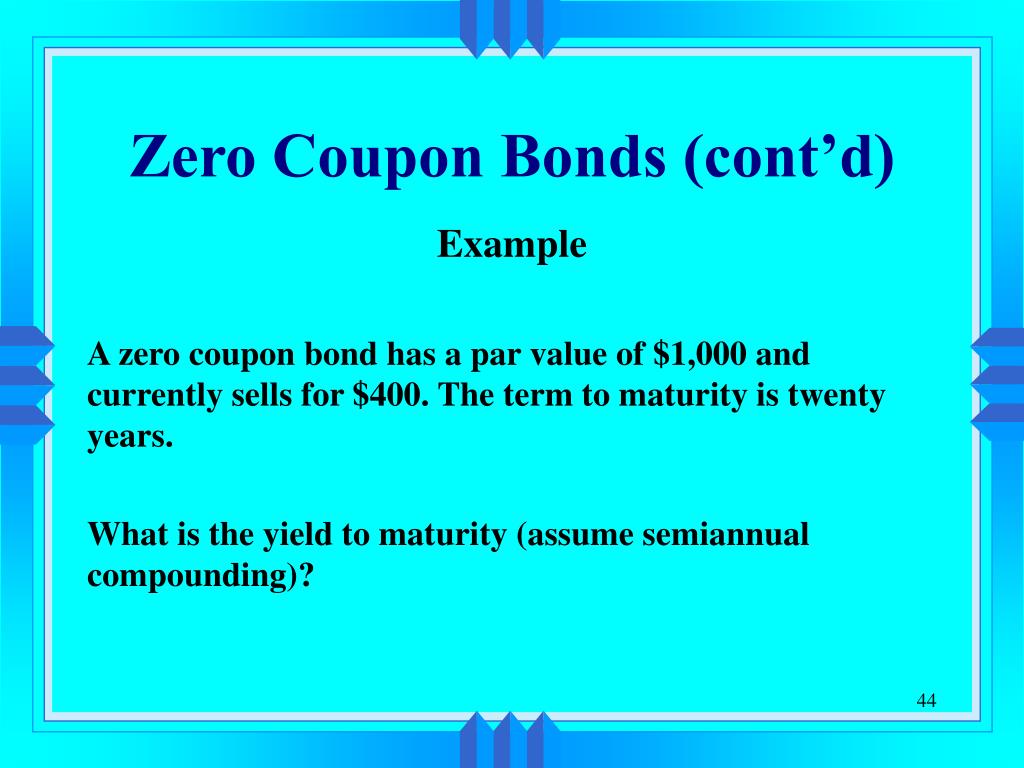

Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far. Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Fixed Income - Definition, Securities, Instruments, Examples On the other hand, Zero-Coupon Bonds Zero-Coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the annual implied interest payment is included into the face ...

Zero coupon bonds definition. Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ... Fixed Income - Definition, Securities, Instruments, Examples On the other hand, Zero-Coupon Bonds Zero-Coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to its par value and does not pay periodic interest. In other words, the annual implied interest payment is included into the face ... Coupon Definition - Investopedia Apr 02, 2020 · Coupon: The annual interest rate paid on a bond, expressed as a percentage of the face value. Zero Coupon Bond (Definition, Formula, Examples, Calculations) = $463.19. Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

![[最も人気のある!] yield to maturity formula zero coupon bond 161022-Yield to ...](https://img.homeworklib.com/images/0fb28cf1-6886-41b8-9d2e-0f4dc641a9e7.png?x-oss-process=image/resize,w_560)

Post a Comment for "43 zero coupon bonds definition"