40 present value of coupon bond calculator

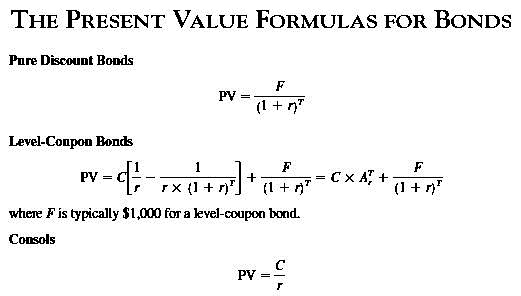

Zero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73. Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

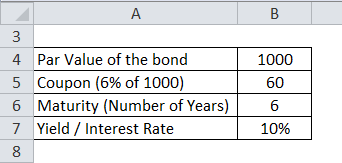

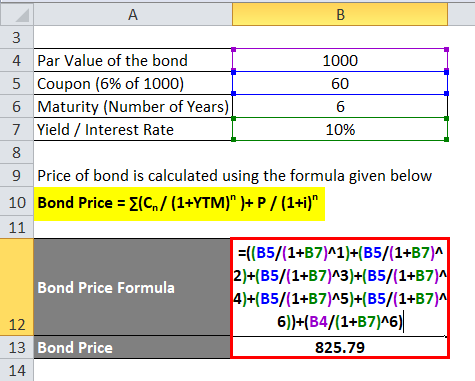

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value.

Present value of coupon bond calculator

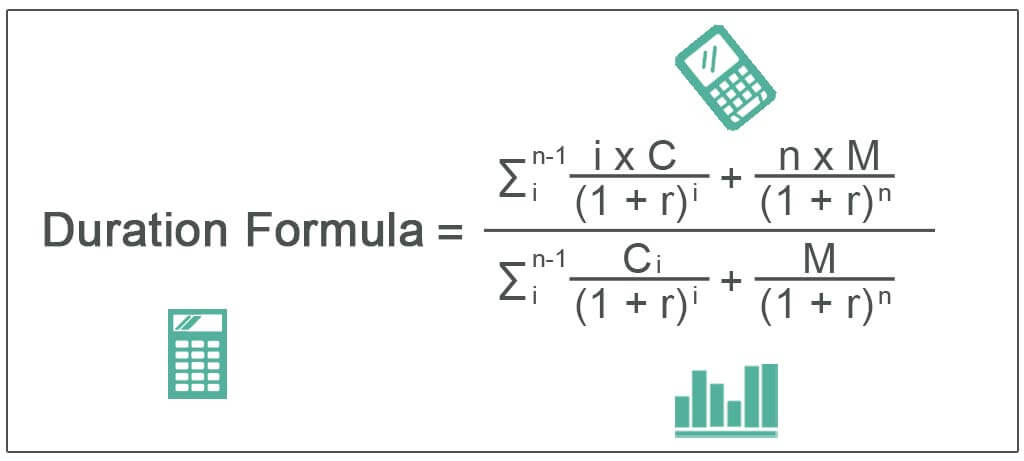

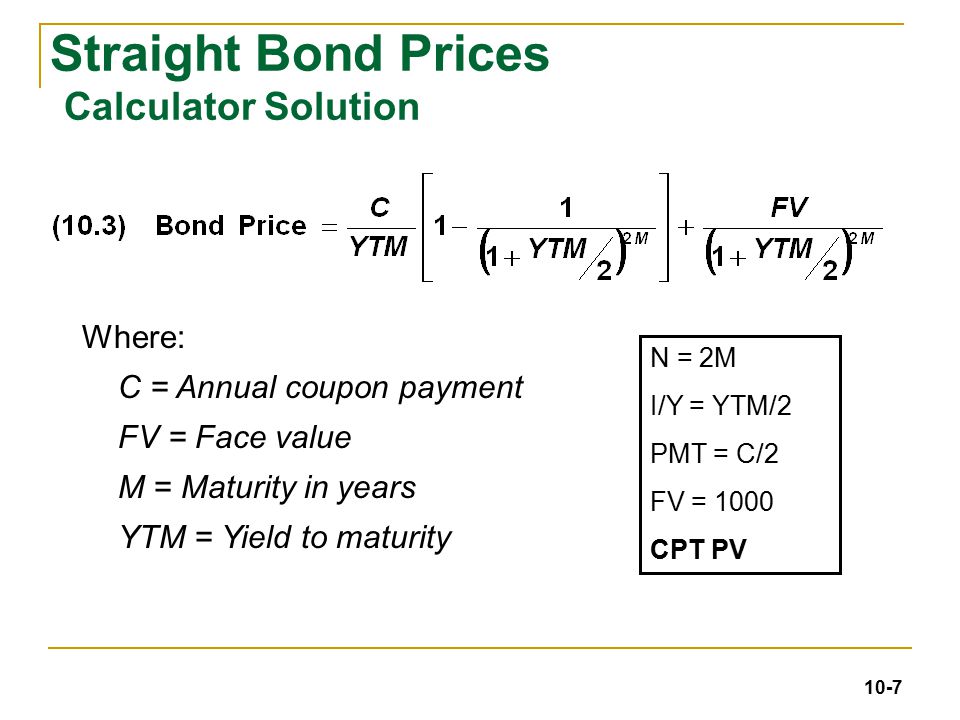

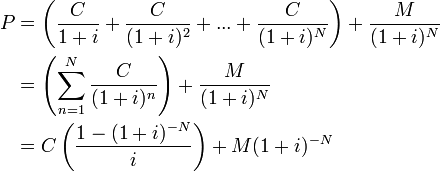

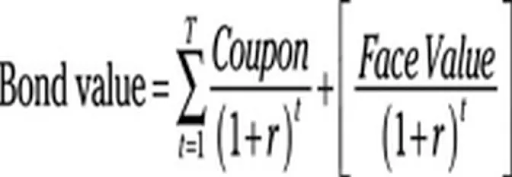

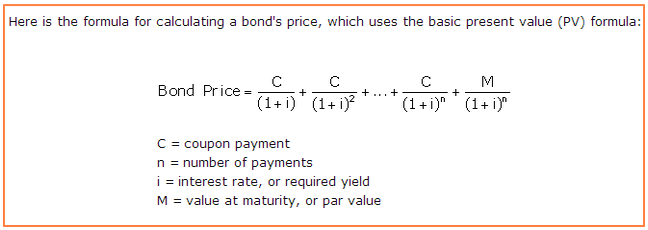

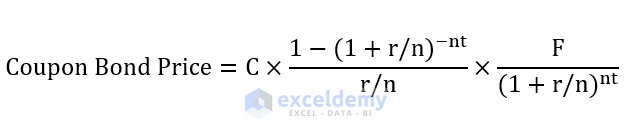

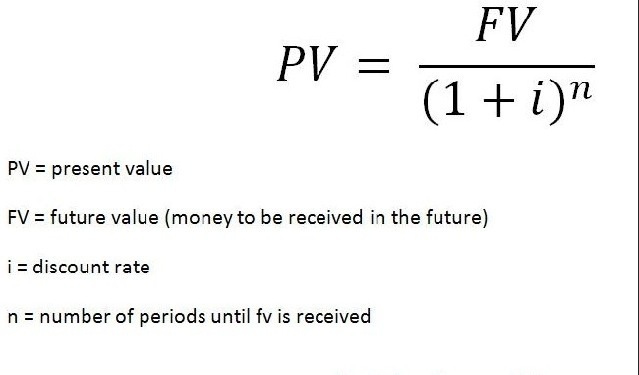

Bond Value Calculator: What It Should Be Trading At | Shows Work! This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value, coupon rate, market rate, interest payments per year, and years-to-maturity. Plus, the calculated results will show the step-by-step solution to the bond valuation formula, as well as a chart showing the present values of the par ... Bond Calculator (P. Peterson, FSU) The purpose of this calculator is to provide calculations and details for bond valuation problems. It is assumed that all bonds pay interest semi-annually. Future versions of this calculator will allow for different interest frequency. Bond Valuation | Meaning, Methods, Present Value, Example | eFM Jun 02, 2022 · The formula to find the present value of one cash flow is: Present Value Formula for Bond Valuation. Present Value n = Expected cash flow in the period n/ (1+i) n. Here, i = rate of return/discount rate on bond. n = expected time to receive the cash flow. This formula will get the present value of each individual cash flow t years from now.

Present value of coupon bond calculator. Bond Basics: Issue Size and Date, Maturity Value, Coupon May 28, 2022 · For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures. The term “coupon” comes from the days when investors would hold physical bond certificates with actual coupons; they would cut them off and present them for payment. Bond Valuation | Meaning, Methods, Present Value, Example | eFM Jun 02, 2022 · The formula to find the present value of one cash flow is: Present Value Formula for Bond Valuation. Present Value n = Expected cash flow in the period n/ (1+i) n. Here, i = rate of return/discount rate on bond. n = expected time to receive the cash flow. This formula will get the present value of each individual cash flow t years from now. Bond Calculator (P. Peterson, FSU) The purpose of this calculator is to provide calculations and details for bond valuation problems. It is assumed that all bonds pay interest semi-annually. Future versions of this calculator will allow for different interest frequency. Bond Value Calculator: What It Should Be Trading At | Shows Work! This free online Bond Value Calculator will calculate the expected trading price of a bond given the par value, coupon rate, market rate, interest payments per year, and years-to-maturity. Plus, the calculated results will show the step-by-step solution to the bond valuation formula, as well as a chart showing the present values of the par ...

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_Oct_2020-01-7b25f37332ff434f9bc3794782fe38fe.jpg)

Post a Comment for "40 present value of coupon bond calculator"