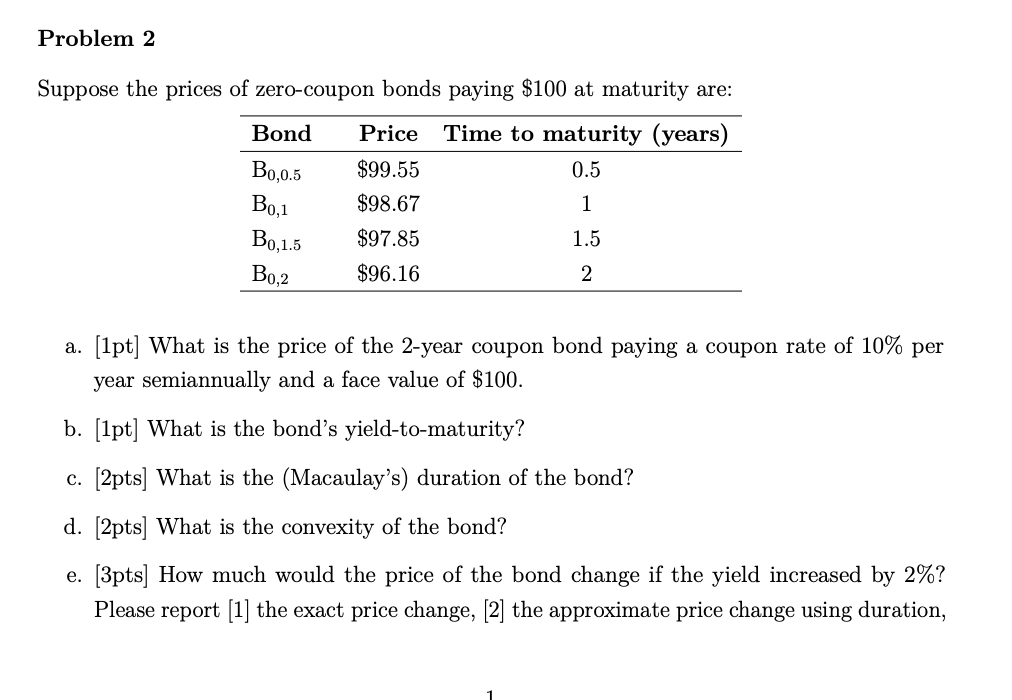

43 pricing zero coupon bonds

Zero Coupon Bond Value - Financial Formulas (with Calculators) To find the zero coupon bond's value at its original price, the yield would be used in the formula. After the zero coupon bond is issued, the value may ... The Zero Coupon Bond: Pricing and Charactertistics An investment dealer will first buy a bond and then “strip” it. The individual coupons are the semi-annual interest payments due on the bond prior to maturity.

Pirelli Global Website: discover our World Find the events, videos & photos from the World of Pirelli, including motorsports and the Pirelli calendar.

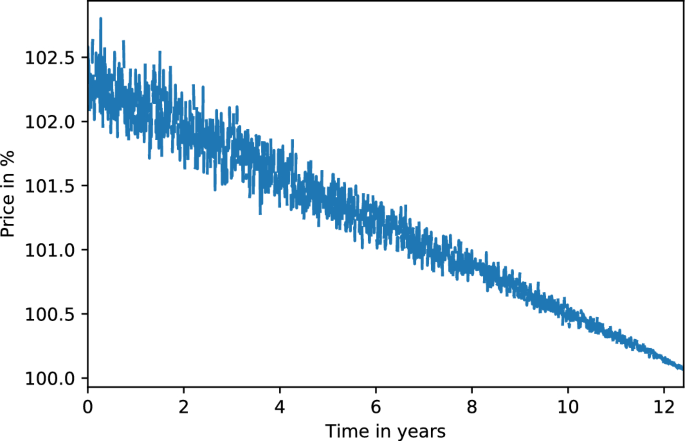

Pricing zero coupon bonds

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 ... With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount ... Coupon Bonds and Zeroes - NYU Stern Coupon Bonds and Zeroes. Concepts and Buzzwords. • Coupon bonds. • Zero-coupon bonds. • Bond replication. • No-arbitrage price relationships. • Zero rates. Bond Price Calculator – Present Value of Future ... - DQYDJ Anyway, this is what we are using for 'the time between payments' internally to the bond pricing calculator: ONE YEAR = 360 Days; TWICE A YEAR = 180 Days; ONCE A QUARTER = 90 Days; ONCE A MONTH = 30 Days; NONE = At Maturity (Zero Coupon Bonds) The accrued interest formula is: F * (r/(PY)) * (E/TP) Where: F = Face value of the bond; r = Coupon rate

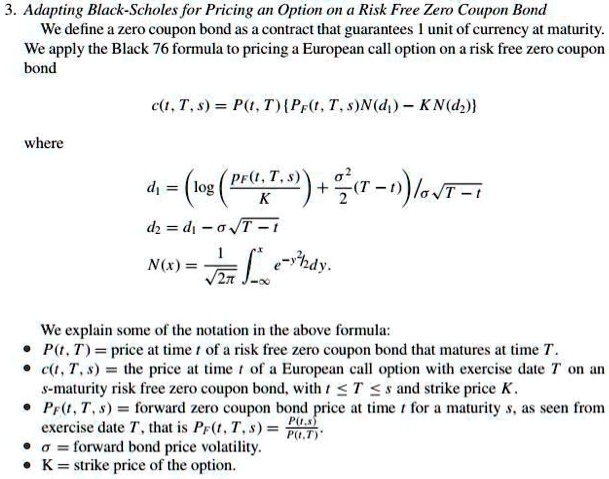

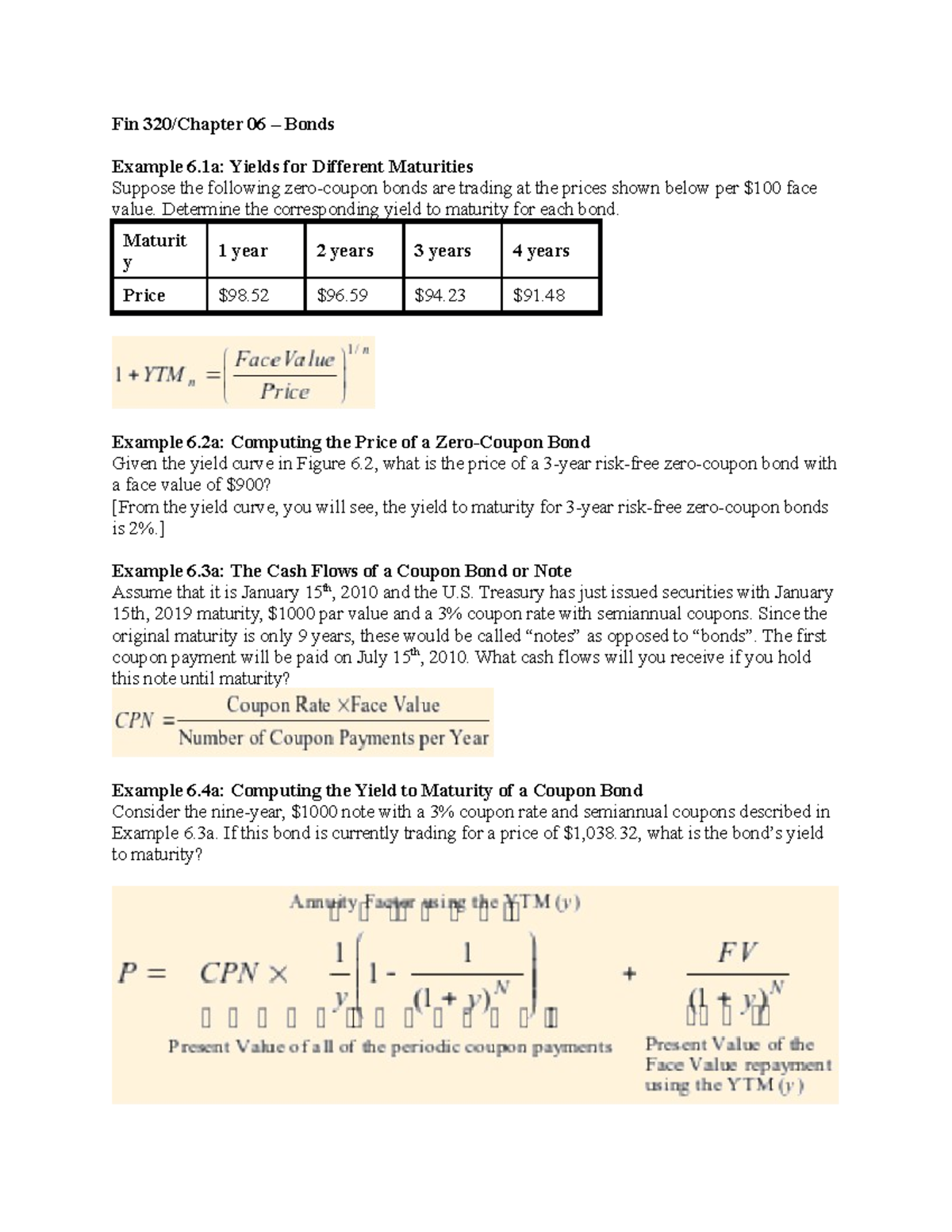

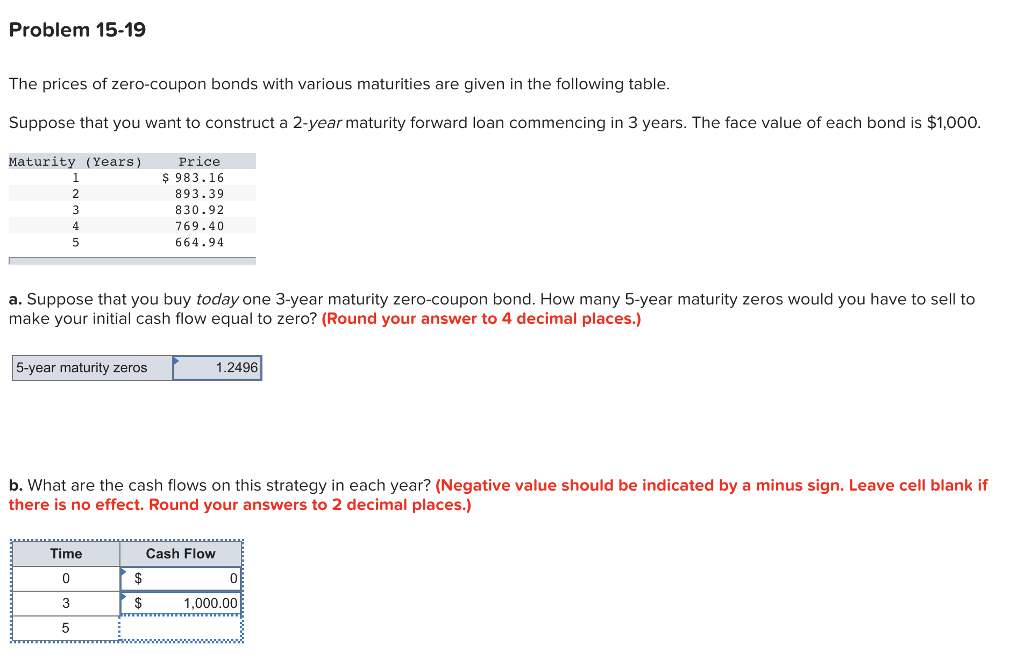

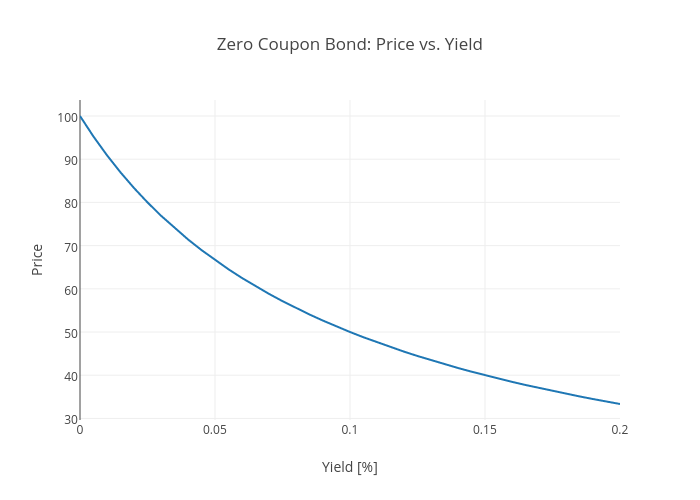

Pricing zero coupon bonds. Zero-Coupon Bond - Definition, How It Works, Formula Oct 26, 2022 ... Pricing Zero-Coupon Bonds · Face value is the future value (maturity value) of the bond; · r is the required rate of return or interest rate; and ... Zero-Coupon Bonds: Characteristics and Examples Zero-coupon bonds are often perceived as long-term investments, although one of the most common examples is a “T-Bill,” a short-term investment. U.S. Treasury Bills (or T-Bills) are short-term zero-coupon bonds (< 1 year) issued by the U.S. government. Learn More → Zero Coupon Bond (SEC) Zero-Coupon Bond Price Formula Zero Coupon Bond | Definition, Formula & Examples - Study.com Feb 18, 2022 ... Maturity dates and interest rates dictate the price of zero coupon bonds. When interest rates are higher, the purchase price is lower. A ... Zero-Coupon Bond: Definition, How It Works, and How To Calculate A zero-coupon bond is a debt security instrument that does not pay interest. · Zero-coupon bonds trade at deep discounts, offering full face value (par) profits ...

Agency Bonds - Fidelity For investors concerned about call risk, non-callable agency and GSE bonds are available in the marketplace. Interest rate risk Like all bonds, GSEs and agency bonds are susceptible to fluctuations in interest rates. If interest rates rise, bond prices will generally decline despite the lack of change in both the coupon and maturity. The degree ... Web Templates | HTML5 Website Templates | Web Graphics The biggest collection of HTML templates, WordPress and ecommerce themes, web graphics and elements online. TemplateMonster offers web design products developed by professionals from all over the world. Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... A zero-coupon bond, as the name implies, does not pay a coupon (interest). So, why would people buy a zero-coupon bond? Basically, the bond is ... Pricing Zero Coupon Bond - Zenodo Investors buy zero coupon bonds at a deep discount from their face value. ▫ A zero coupon bond generates gains from the difference between the purchase price ...

United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006. Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data Bond Price Calculator – Present Value of Future ... - DQYDJ Anyway, this is what we are using for 'the time between payments' internally to the bond pricing calculator: ONE YEAR = 360 Days; TWICE A YEAR = 180 Days; ONCE A QUARTER = 90 Days; ONCE A MONTH = 30 Days; NONE = At Maturity (Zero Coupon Bonds) The accrued interest formula is: F * (r/(PY)) * (E/TP) Where: F = Face value of the bond; r = Coupon rate Coupon Bonds and Zeroes - NYU Stern Coupon Bonds and Zeroes. Concepts and Buzzwords. • Coupon bonds. • Zero-coupon bonds. • Bond replication. • No-arbitrage price relationships. • Zero rates.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Oct 20, 2022 ... With a zero, instead of getting interest payments, you buy the bond at a discount from the face value of the bond and are paid the face amount ...

Post a Comment for "43 pricing zero coupon bonds"