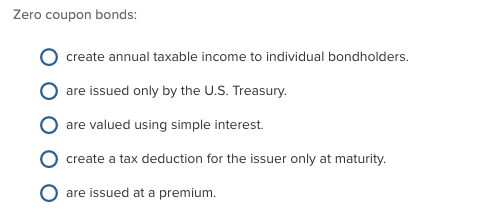

44 are zero coupon bonds taxable

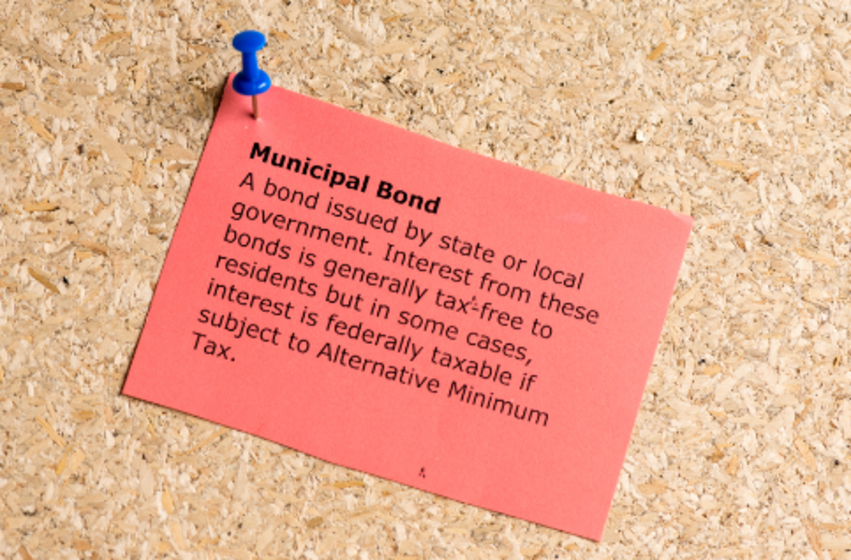

Zero Coupon Bonds: Know tax rules when such a bond is held till ... When a zero coupon bond is bought from primary market and sold in secondary market through recognized stock exchange Unlike Taxation of Bonds, the Taxation of zero coupon bonds does... Tax Considerations for Zero Coupon Bonds - m.finweb.com Municipal zero coupon bonds--Municipal bonds are those that are issued by certain government entities like city governments and school districts. Interest that is earned on municipal bonds is not taxable. Therefore, you can simply buy the zero coupon bond and then collect your interest at the end without worrying about anything in between.

Tax Considerations for Zero Coupon Bonds - Financial Web Municipal zero coupon bonds--Municipal bonds are those that are issued by certain government entities like city governments and school districts. Interest that is earned on municipal bonds is not taxable. Therefore, you can simply buy the zero coupon bond and then collect your interest at the end without worrying about anything in between.

Are zero coupon bonds taxable

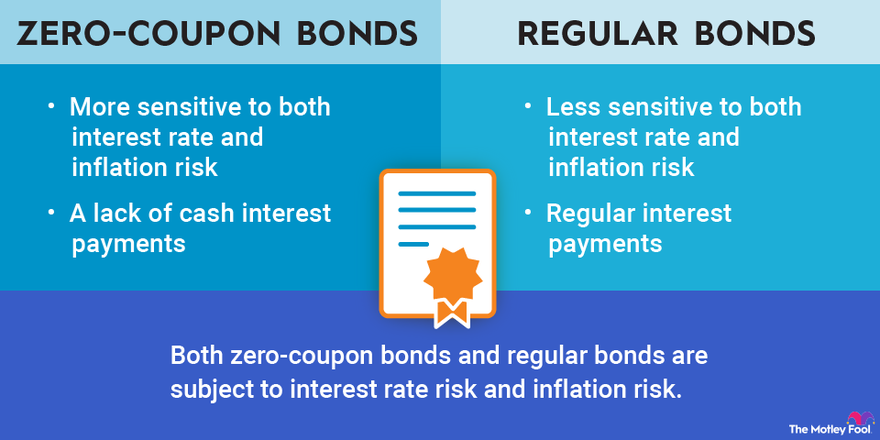

Should I Invest in Zero Coupon Bonds? | The Motley Fool Most people think of bonds as being appropriate for those who need regular current income without a huge amount of risk. Yet some bonds are structured specifically not to pay income currently.... How is tax calculated on a zero coupon bond? - Quora When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. For example, suppose you were currently aged 58 and earning enough money to be in a fairly high tax bracket. How to Invest in Zero-Coupon Bonds - US News & World Report The problem can be avoided with a tax-free municipal zero-coupon bond, or by holding the zero in a tax-preferred account like an individual retirement account. Volatility is a second issue.

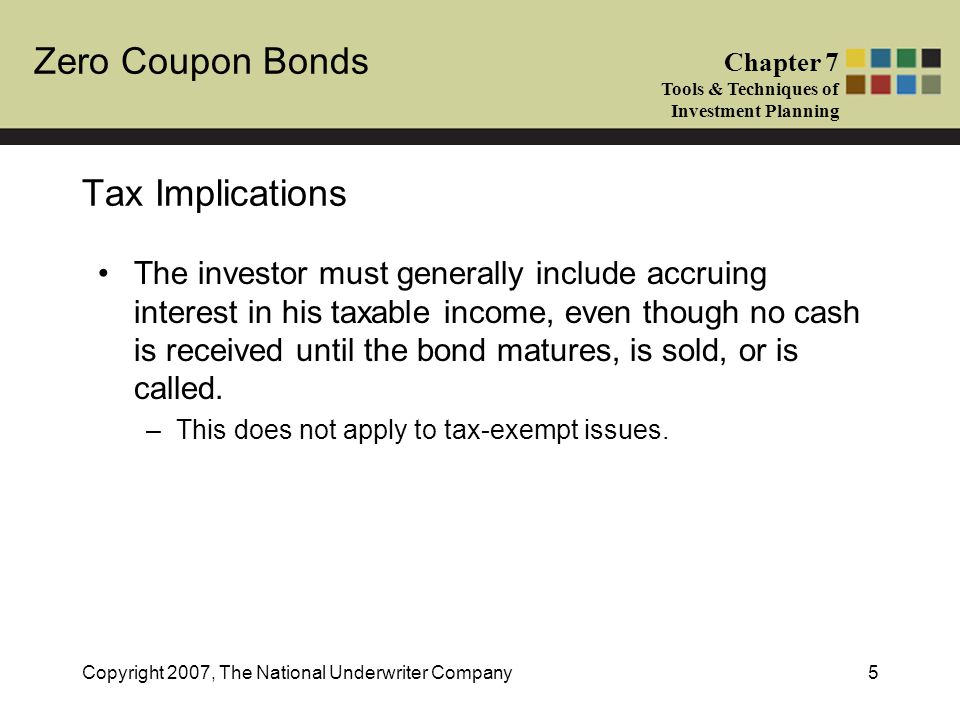

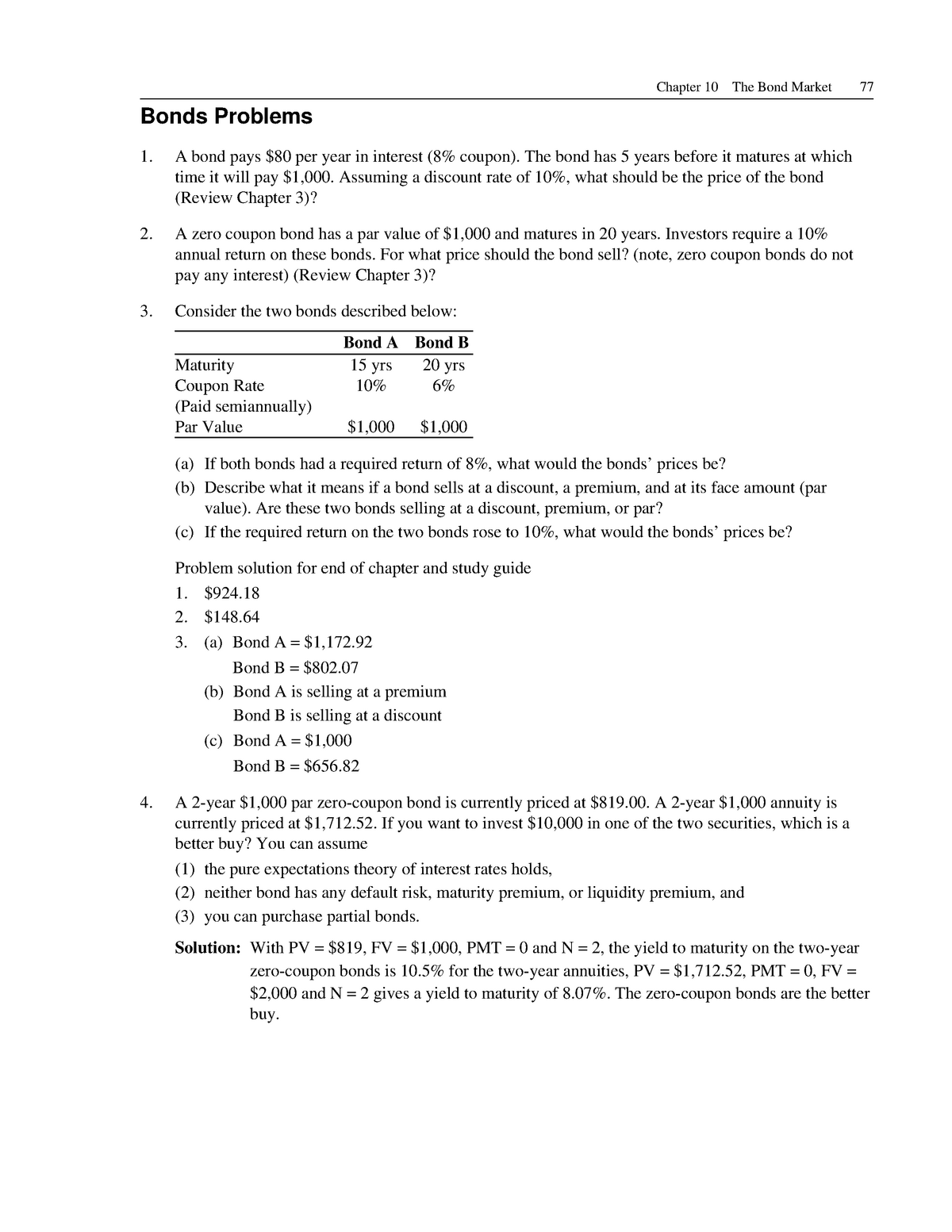

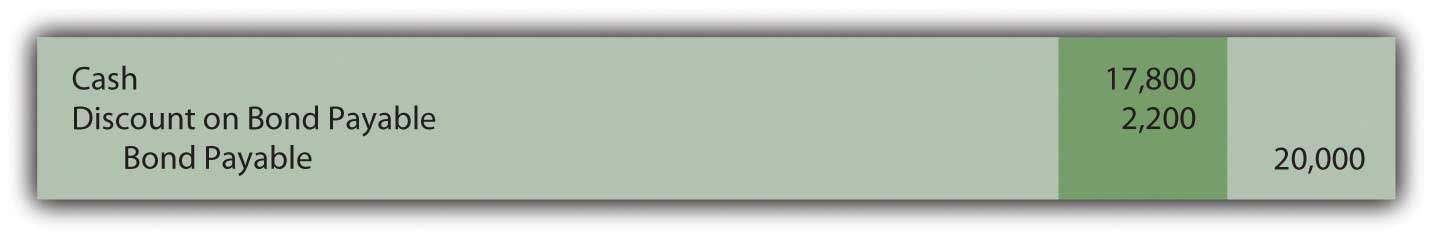

Are zero coupon bonds taxable. Zero Coupon Bonds - Taxation, Advantages & Disadvantages - Fisdom Zero coupon bonds that are notified and issued by REC and NABARD are taxable. Earnings from zero coupon bonds are also subject to capital gains tax at the time of maturity. The earnings or capital appreciation for zero coupon bonds is the difference between the maturity value and purchase price of the bond. Who should invest in Zero Coupon Bonds? Do you pay taxes on zero coupon bonds? - Quora When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. For example, suppose you were currently aged 58 and earning enough money to be in a fairly high tax bracket. Zero Coupon Bond | Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. Zero-Coupon Bonds: Characteristics and Calculation Example Zero-coupon bonds, also known as "discount bonds," are sold by the issuer at a price lower than the face (par) value that is repaid at maturity. Zero-coupon bonds are debt obligations structured without any required interest payments (i.e. "coupons") during the lending period, as implied by the name. Instead, the difference between the ...

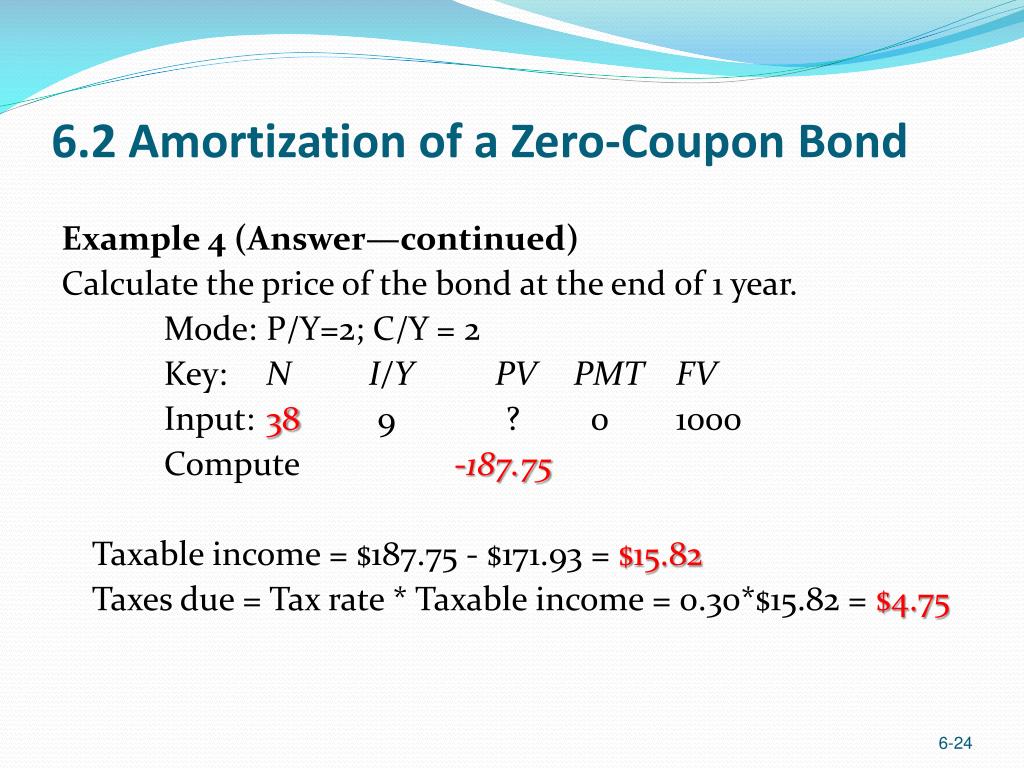

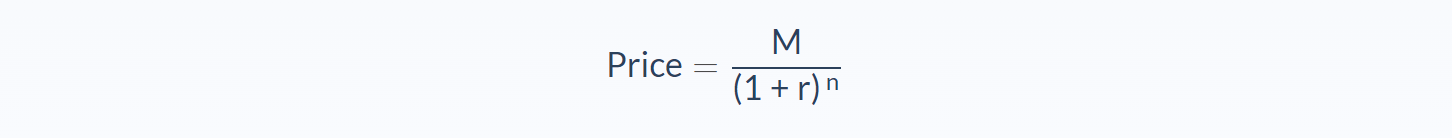

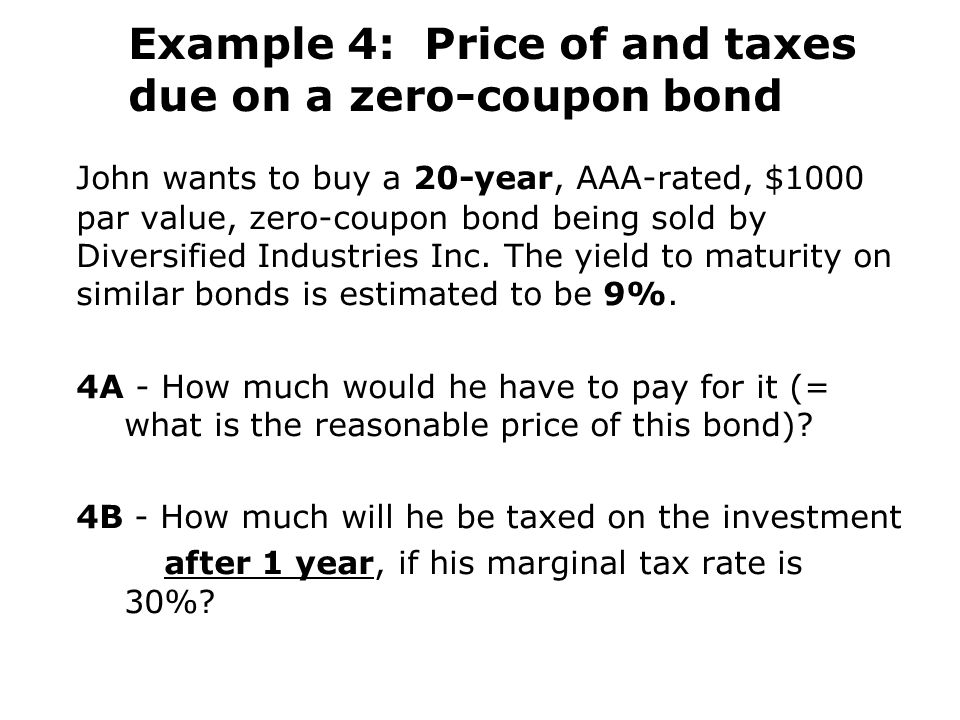

Section 2(48) Income Tax: Zero Coupon Bonds - CA Club Income arising from zero coupon bonds as defined in Section (48) (2) shall be taxed only in the year in which same is transferred or redeemed or matured. Tax liability of investor on transfer of zero coupon bonds may be either short term or long depending upon the holding period, i.e. for not more than 12 months or otherwise. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ... What is the tax implication on zero coupon bonds? Updated. Any long term capital gain on sale of zero coupon bonds shall be charged to tax at minimum of the following: 20% of LTCG After indexation of cost of such bonds or 10% of LTCG before indexation of cost of such bonds. Zero coupon bonds, Investing in Zero Coupon Bonds, Tax Considerations for Zero Coupon Bonds Explained the tax implication ... The One-Minute Guide to Zero Coupon Bonds | FINRA.org One last thing you should know about zero-coupon bonds is the way they are taxed. The difference between the discounted amount you pay for a zero-coupon bond and the face amount you later receive is known as "imputed interest." This is interest that the IRS considers to have been paid, even if you haven't actually received it.

Zero coupon municipal bonds maturation - Intuit The tax rules for zero-coupon bonds bought as new issues and held to maturity are fairly simple. Whether the bond is taxable or tax exempt, you (or your broker) have to accrue interest on the bond. Zero-Coupon Bond - Definition, How It Works, Formula As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. PDF Income Taxes on Zero Coupon Bonds (Preliminary Version) payments. First the yield needs to be calculated. We will present a simplified three year zero coupon bond as an example. The taxable zero coupon bond is purchased for P = $900 with a value at maturity M = $1000 in three years. Let y = yield so that (1) 900(1 + y)3 = 1000, y = 1 1000 3 900 ªº «»¬¼ - 1 = .0357442 = 3.57442% . Next the (phantom How to Invest in Zero-Coupon Bonds - US News & World Report The problem can be avoided with a tax-free municipal zero-coupon bond, or by holding the zero in a tax-preferred account like an individual retirement account. Volatility is a second issue.

How is tax calculated on a zero coupon bond? - Quora When zero coupon bonds first came out, you only paid tax when you sell them or at the end of their terms when you cash them in. This was one of the attractive aspects of zero coupon bonds for some people. For example, suppose you were currently aged 58 and earning enough money to be in a fairly high tax bracket.

Should I Invest in Zero Coupon Bonds? | The Motley Fool Most people think of bonds as being appropriate for those who need regular current income without a huge amount of risk. Yet some bonds are structured specifically not to pay income currently....

Post a Comment for "44 are zero coupon bonds taxable"